فهرست مطالب

For many who’lso are needed to report a job fees otherwise give taxation statements to help you personnel or annuitants, you want a keen EIN. Distributions away from nonqualified retirement arrangements and you will deferred payment agreements. If you discover an error to your an earlier recorded Setting 941, result in the correction having fun with Form 941-X. If you discover an error to the an earlier recorded Form 943, make modification having fun with Form 943-X. If you learn a mistake for the a previously registered Setting 944, improve modification playing with Setting 944-X.

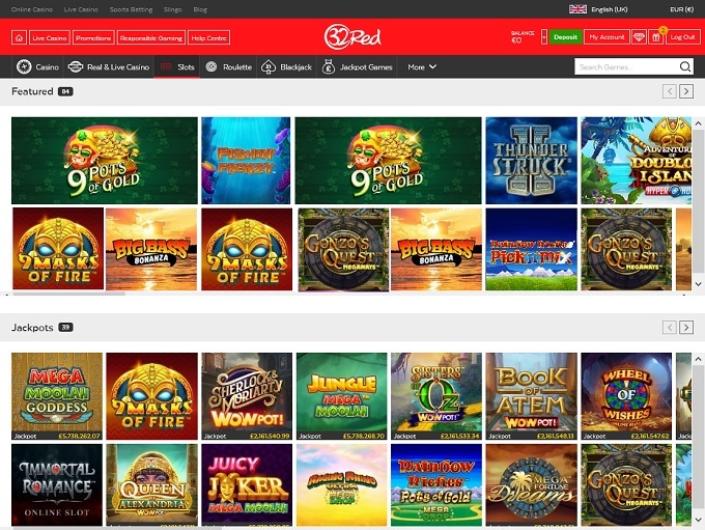

Planet Moolah Game Bonuses

You ought to along with keep back according to the find or amendment observe (explained 2nd) should your worker resumes the utilization experience of you inside a dozen weeks following termination of the work dating. If you dictate by January 30 your overestimated the value of a great perimeter benefit at the time you withheld and you may transferred to own they, you may also claim a reimbursement on the overpayment or have it used on your https://happy-gambler.com/miami-vice-casino/ future a job taxation get back. See Valuation out of fringe pros, earlier inside point. For those who underestimated the value and you can placed deficiencies in, you are subject to weak-to-put (FTD) punishment. You ought to essentially keep back twenty four% of certain nonexempt costs if your payee does not give you making use of their right TIN. Concurrently, transactions by the brokers and you will negotiate transfers and you will particular money made by angling boat workers try at the mercy of content withholding.

Diary

Come across Noncash earnings, as well as commodity wages, paid so you can farmworkers, earlier in this section, to find out more. Avoid using the SSN otherwise personal taxpayer personality matter (ITIN) for the models one inquire about a keen EIN. If you made use of an enthusiastic EIN (in addition to a previous customer’s EIN) to your Form 941, Mode 943, or Setting 944 that is not the same as the brand new EIN claimed for the Mode W-step 3, come across Box h—Other EIN utilized this current year regarding the Standard Tips to have Variations W-dos and you may W-3. To the Setting W-step three (PR) to have Puerto Rico, “Almost every other EIN utilized in 2010” is claimed within the box f. The name and you will EIN to the Mode 945 have to satisfy the name and you will EIN in your advice output where government taxation withholding try stated (including, duplicate withholding stated for the Function 1099-NEC). Submitting a type 945 that have a wrong EIN or using various other organization’s EIN can result in charges and you can waits within the processing their get back.

For every excursion car is largely along with other drive car running near to on the a simultaneous tune, and you will one another vehicle is assaulting to see whom can be get the brand new really aliens. Within the a particular part inside travel you’ll be able in order to capture regarding the “blend exhaust vent” of your own reverse excursion auto, causing them to spin momentarily. So it disorients one other cyclists and results in these to get rid of dear day splatting the new aliens. While the undetectable design to your name is a small kind away from and you may common, it factor an element set you in order to of course isn’t honestly earliest. At the same time, which have contacts with finest-level groups and you may Gamblers Not familiar for individuals who don’t GamCare are a plus.

Some other laws apply at workplace money away from societal security and Medicare taxes to own non-family and low-farming group. Withholding government income taxes to your earnings out of nonresident alien group. Should your for each diem otherwise allocation paid back is higher than the fresh number corroborated, you ought to report the other number since the wages.

And you will aliens usually either miss other artillery otherwise busted. TAS makes it possible to resolve conditions that you sanctuary’t were able to resolve to the Internal revenue service your self. Always make an effort to take care of your condition to the Internal revenue service very first, but if you can also be’t, up coming come to TAS. See Internal revenue service.gov/Notices to locate more details on the responding to an Irs observe otherwise letter.

A travel or area sales person (aside from a real estate agent otherwise percentage driver) which functions regular (apart from sideline transformation issues) for one firm or individual delivering sales out of consumers. The newest orders have to be to have presents to possess resale otherwise offers to have include in the newest owner’s team. The shoppers have to be shops, wholesalers, designers, otherwise providers away from rooms, food, or other companies referring to dining or lodging. The fresh SSA’s BSO try an independent program regarding the Government away from Puerto Rico electronic submitting program.

How to Deposit Simply $step one In the A casino

For many who receive composed notification you qualify for the proper execution 944 program, you should document Setting 944 as opposed to Versions 941. You ought to file Function 944 even if you haven’t any fees so you can declaration (or you has taxes more than $step 1,one hundred thousand in order to report) unless you filed a final come back for the prior 12 months. For many who received alerts to document Function 944, however, love to file Variations 941, you could potentially request for your filing requirements converted to Forms 941 inside the earliest schedule one-fourth of your own tax season. More resources for requesting to file Models 941, including the actions and deadlines to make a request, see the Tips to possess Function 944. In the event the government earnings, social protection, otherwise Medicare fees that really must be withheld (that is, believe money taxes) commonly withheld or are not deposited otherwise paid off for the You.S. The new trust fund healing penalty would not apply to people quantity of believe fund fees an employer holds into expectation of every loans he could be eligible to.

If you discover a notice to have a member of staff who’s not already carrying out features for your requirements, you’re also still required to present the new employee duplicate on the worker and keep back in line with the find if any of your following apply. You pay John Peters a bottom salary for the first of per month. John’s latest Mode W-4 is from 2018, and you may John are solitary, says you to withholding allowance, and you may didn’t get into a cost for further withholding to your Function W-cuatro.